Michigan’s Flat Tax

Over the next few weeks and months, we will be publishing some brief papers on various federal and state taxes and how they impact taxpayers in Michigan and the UP. They are provided as background and information, not as advocacy pieces. It is information we found important and interesting that we thought would be informative for all of us. Our purpose at Rural Insights is to “ensure citizens have accurate and nonpartisan information about issues that impact rural life in Michigan’s Upper Peninsula and life in this rural area.” Also, to “ensure that citizens and policy makers have the data, facts, and information to make informed decisions about the UP and life in this rural area.”

Michigan is one of nine states of the Union that has a flat rate income tax.

On top of the 4.25% charged by the state, Michigan cities can charge an additional income tax, 2.40% with Detroit being the highest.

Most states, besides the ones with no income tax, enjoy a progressive income tax rate like that of the federal government. Of the states currently levying a broad-based personal income tax, all but nine apply graduated tax rates (higher tax rates applied at higher income levels).

Colorado, Illinois, Indiana, Kentucky, Massachusetts, Michigan, North Carolina, Pennsylvania, and Utah tax income at one flat rate. The major reason Michigan has a flat income tax is it’s constitution.

Stated in the constitution article nine, section seven: “No income tax graduated as to rate or base shall be imposed by the state or any of its subdivisions.” The Michigan constitution was ratified in 1961.

According to MichBar.org: “The delegates’ task was difficult. Michigan’s existing Constitution, which had been amended 70 times, no longer suited the dynamic national industrial leader the state had become.”

Since that time, there have been a total of 22 bills introduced to either allow graduated income tax or to get rid of the prohibition. The latest was introduced by Sen. Jeff Irwin (D) on August 28, 2019:

“To replace Michigan’s flat-rate income tax with a graduated income tax, starting with a 3% rate on individual income up to $20,000, 4% on income between $20,000 and $40,000, 5% on income between $40,000 and $80,000; 6% up to $125,000; 7% up to $200,000; 8% up to $500,000; 9% up to a $1 million; and 10% on higher amounts. This is contingent on two-thirds of the state House and Senate voting to place Senate Joint Resolution D on the ballot, and a 50%-plus-one vote of the people voting to adopt it.”

The main purpose for a progressive or gradual tax is to lessen the incidence of pay on people who have a harder time paying, while shifting the larger portion to people who can pay.

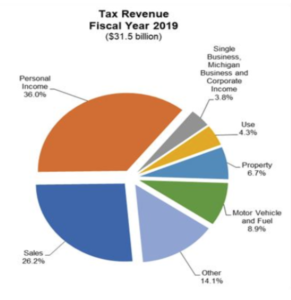

It also increases the state’s revenue. In 2019, the state of Michigan collected $11.4 billion from income tax. Most states are required to meet balanced budgets, and Michigan is no exception.

With the advent of COVID-19, Michigan has been prompted to tap into its “rainy day” fund to meet the financial needs of its economy. Another option for Michigan is to raise the flat income tax instead of switching to progressive.

For instance, a marginal increase of .0425% would raise an additional $114 million. Conversely, there are many complicated issues that arise with tax increases. U.S. Bureau of Labor Statistics data shows that wages, employment and economies grow faster in non-progressive states.

The other side of the coin is a larger revenue for state services at least in the short run, which means more funding for services and infrastructure. It’s hard to say what is more fair as the tax is a percentage of total income.

Each side has great and well-thought-out arguments as to why it should be one way or another.

Almost all the recent bills introduced in favor of a gradual tax only lower the bottom bracket by less than a half of a percent to one percent, meaning people who already struggle to meet the criteria are only getting a marginal break while the top earners will see a 3-4% increase as to what they are already paying.

But for lower earners, this is a much larger percent of disposable income. There is also data to suggest top earners who have the ability to move according to the US Census Bureau tend to migrate to flat tax states to avoid the steep taxes on net.

Another problem with progressive taxes is the incentive to earn less and stay within a bracket which increases the deadweight loss from taxes and discourages upward mobility. No state since 2000 has switched from a flat rate individual income tax structure to a graduated structure.

However, three states have switched from a graduated individual income tax rate structure to a flat rate tax. It’s an interesting question, and something that citizens should be knowledgeable about as it affects their state government’s income and their wallets.

Sources:

https://www.michbar.org/programs/milestone/milestones_1961-62constitutionalconvention

https://www.michigan.gov/budget/0,9357,7-379-88601_91413_91645-139069–,00.htm

State Budget Office. “How Much Tax Does the State Collect?” State Budget Office – How Much Tax Does the State Collect?, 2019, www.michigan.gov/budget/0,9357,7-379-88601_91413_91645-139069–,00.html

I would be very interested to understand the effectiveness of governing on a state by state basis with the dollars they have. How much waste is in the system? Interesting to look at the cost per capita of state expenditures. According to KFF.org Michigan lands at 17 on the list(in 2018) of the lowest cost per capita.

I dont like the graduated tax, it encourages business owners and high earning individuals to play more games and ultimately relocate to no-income-tax states. I would prefer to see a higher use tax and a lower(ideally no) income tax.

https://www.kff.org/other/state-indicator/per-capita-state-spending/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Per%20Capita%20State%20Spending%22,%22sort%22:%22asc%22%7D

I always find the arguments for a graduated tax quite interesting. As devil’s advocate, let’s look at the following logic. Everyone in the state makes use of certain essential services. It is “fair” that everyone should pay some amount for those services. Say, for argument that amount is set at $100 per person. But some people get additional services from the state government. Those people might be expected to pay more because they get more. BUT those people are typically unable to pay more because the reason they get those services is because they have limited financial resources. Okay, so we don’t charge them extra. To fund these extra service, then we have to go to the people who have more resources. Instead of a flat $100 per person, we instead change a percentage of income. That means people who earn less pay less. Just suppose a 5% tax rate. A person earning $20K would pay $1000 in taxes, while a person earning $100K would pay five times as much, or $5000. One might say that this is “fair” and “equitable” because everyone has the same tax burden relative to their income. However, the graduated scheme goes one step further and increases the tax rate as income grows. In its initial incarnation, it attempts to maintain equity by saying the everyone pays Rate A for the first 20K, but if you earn more, then in the next bracket, you have to pay a higher tax rate. In the example given in the article, a person who earns $1 million would pay $80,000+ per year just in state taxes–that’s eighty times the amount paid by the $20K earner, and twice the amount he or she would pay under the current 4.25% flat tax. The federal government would take even more. $518,000! So this person who earned $1 million would be taking home only $400K–less than half his or her earnings. That said, we might reconsider the meme that wealthy people don’t pay “their fair share” of taxes. Should Michigan follow other states and institute a graduated tax? What’s fair and equitable?

I think most people would rather make a $1,000,000 if had the chance. Now say they clear $400,000 after taxes. I would take paying the higher taxes and still be better off than the person making $20,000 per year. I was raised in poverty and don’t want the kind of lifestyle again.

This article seems to be advocating for a certain tax policy, and just presenting the facts.

No advocacy anywhere in the article. Preface states our purpose with this article and all we publish. The facts, data and information, not advocacy. Happy to talk to you about it. Cheers. H

I agree with one of the authors, David Haynes, that there was no advocacy in the article, just facts and information. I have always felt a flat tax (not a “fair” tax which is really a VAT that is really regressive) should be our Federal Income tax. My main objection to the current progressive Fed tax is DEDUCTIONS. This is why people claim “the wealthy don’t pay their fair share”, because in too many cases they do NOT. High income earners who actually pay the nominal tax are actually cheated big time by those who deduct their tax burden down to zero. Here is another argument against the progressive state income tax mentioned in the article. “U.S. Bureau of Labor Statistics data shows that wages, employment and economies grow faster in non-progressive states.” A real analysis of the fairness and effectiveness of each tax is badly needed.