National Student Loan Forgiveness, Finland, Russia, and the Upper Peninsula, and NMU Holocaust Exhibit

National Student Loan Forgiveness and Congress and Others

Facts to Consider Before Making Our Minds Up On Student Loan Forgiveness

Nationally there are 43 million student loan borrowers. The average student loan balance in Michigan is $36,642–the 18th highest in the US (Michigan is the 10th largest population state).

According to the Michigan Office of the Governor 1.4 million Michigan residents will see some effect and 700,000 will have their debt cut in half or eliminated completely.

We have also learned in the past weeks that there are other programs that have loans forgiven and subsidized for various reasons.

One interesting fact we were given about this issue involves the staff of the US Senate and US House. If you work for a US Senator or a US Representative you get money toward paying off your student loans. If you work in the US House a staffer gets $833 per month or a US Senate staff member you get $500 per month towards your student loan repayment.

No repayment of this Congressional subsidy for staff required. Nearly 2,000 staffers take part in this program.

So, as members of Congress criticize the student loan forgiveness program, ask them how many of their staff are getting Congressional loan forgiveness payments. Or how many members of Congress personally got PPP payments and had their loan forgiven. The average forgiven under the PPP was $95,700 and 11.8 million businesses across the country took part in the PPP.

One more observation is that members of the US Armed Forces have to serve three years of military service to get their tuition paid via the GI Bill. Service for loan forgiveness. Military veterans are the only ones required to give national service before getting loan forgiveness.

On a personal note, I received the GI Bill when I went to college and I took out student loans. Paid them back. I should also note what I currently know about this new loan forgiveness program, I am glad that young people today will not have to struggle with loan debt.

Many of us hope that this will bring a focus on the increasing high cost of higher education and how that can be controlled in order to help more young people go to college and not have to take out loans in the future. Also more opportunities for young people to do various types of national service in return for free tuition.

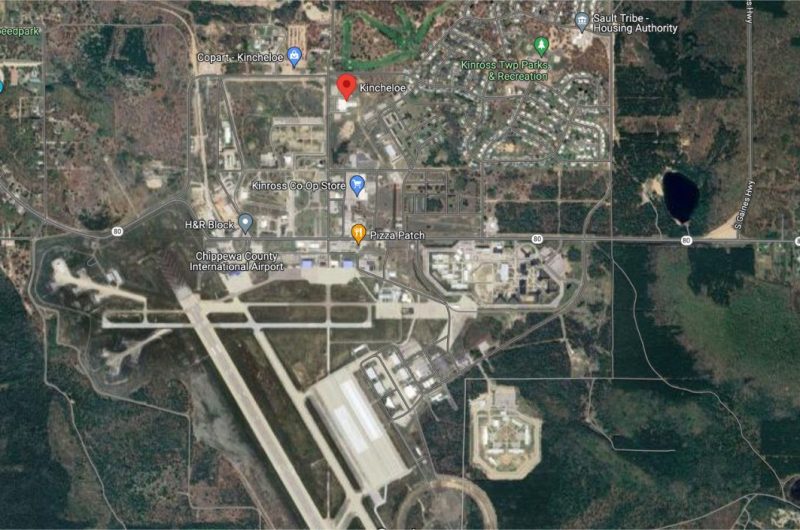

Finland, Russia and the Upper Peninsula

Since so many of our friends and neighbors in the UP have some Finnish heritage we thought this data was interesting. Key number is 90%. That is the amount of visas to Russians that Finland will slash due to Russia’s ongoing war with Ukraine. Starting in September Finland will accept daily only 10% of visas requested by Russian tourists, compared with the 1,000 successful Russian visa requests per day currently.

NMU–“Americans and the Holocaust”

Olson Library at Northern Michigan University will host the traveling national exhibit entitled “Americans and the Holocaust.” It is co-sponsored by the United States Memorial Holocaust Museum and the American Libraries Association.

It is free and open to the public from September 13th thru October 24th.

There are some really interesting events planned at NMU during this exhibit and also two at Marquette’s Peter White Library downtown.

Go to NMU’s website to get more information.

Don’t miss this exhibit and the events built around it.

Books Recommended By Our Readers

“True North: Emerging Leader Edition.” Will Bunch and Zach Clayton. 2022. These authors talk to over 200 executives about how they mix leadership with purpose and how to lead through today’s crises.

Quotes That Make Us Go Hmmm

“Honesty has no defense against pure cunning.” Jonathan Swift.

“The truth has no defense against a fool determined to believe a lie.” Mark Twain.

Labor Day Next Monday

No Whispers next Monday, Labor Day, September 5th. See you on September 12th.

Talk To Us

Keep your raves, laurels, rants and darts coming. Send them to us at david@ruralinsights.org. We love to read them.

About Us

Rural Insights connects policy, information, news and culture to raise topics and stories/information you might have not seen or overlooked. We bring you original writing from Rural Insights and other researchers, change makers, and storytellers, as well as our latest research and analysis.

Like Whispers?

If so, please forward it to your friends, and let them know they can sign up here or on our website: www.ruralinsights.org.

TWITTER: Follow us @ruralinsightsUP.

5 Comments

Leave a Comment

Newsletter

Related Articles

I enjoy your writing. Thank You

I had a student loan from NMU of $400 which I took out in my last semester in 1976. It was at 3%. I think I had 10 or 12 years to repay it. I paid it quarterly I think and it was a pittance. I refused to pay it off early as I suspected I would never again see a 3% loan (remember rates in the 1980s?). Some in my generation criticize this loan forgiveness, and I am not fully on board with allowing family incomes as high as $250,000 to take advantage of it (data shows the vast majority of these loans are from people with incomes of $45,000 to 80,000 per year however). NMU and most state universities in the mid 70s had much more state aid given to them for tuition, and they hadnt joined the raise the tuition to appear elite trend of colleges that we started seeing in the 90s….so I do commiserate with people who have paid $25,000 to 50,000 per year for their college tuition compared to what I paid. Some small relief isnt out of line.

Comparing PPP loan forgiveness with student loan forgiveness is somewhat misleading. The “deal” from the start–written into the contract–was that PPP loans would be forgiven if employees were retained. Student loans had no such wording in the contracts. Students who accepted those loans were expected to do the responsible thing and pay them back. Unfortunately, many college-bound students did not have good training in finance and perhaps 1) didn’t read the contract 2) didn’t understand what the monthly payments would be 3) had no idea of their earning potential based on their college degree. Clearly the educational system failed to prepare these students for the financial realities of life. Even more unfortunately, forgiving student loans will not rectify this situation, though it may alleviate the financial burden under which these students suffer. Let’s be clear, however, that it is not Mr. Biden who is forgiving these loans, but us taxpayers. Graduates with loans, please appreciate what WE are doing for you.

Former House staffer…I got $250 a month when I worked on the Hill. My loans were recently forgiven as I work for EPA. My federal service is 19 years now. My loans were only forgiven this year. This program has been poorly implemented by numerous Administrations and I’m grateful the Biden Administration made reform a priority.

The problem is our education policy failures. 24 nations have free higher education. America has declined in STEM education for the last two decades. Investing in free higher education is investing in America’s economic success, research and development, entrepreneurship and ultimately our national security.

I was accepted to the MBA program at NMU in 1980.I was unable to attend due to prior indebtedness from undergrad studies. I would never have come back under the bridge if I had gone there.