Earned Income Tax Credit: Max Steele’s Analysis

Rural areas have several demographic components that lend themselves to having a great need for Earned Income Tax Credits (EITC), a sort of negative income tax targeted towards low income, working families, with kids. This holds true for Michigan’s Upper Peninsula (UP).

The UP is a charming place with much hospitality, plentiful nature. However, in terms of its industry, life can be a little lackluster. Its rural nature creates some disparities between counties in terms of wealth, income, and population. This paper will look into some of these factors and relate how they affect EITC in UP and around the state.

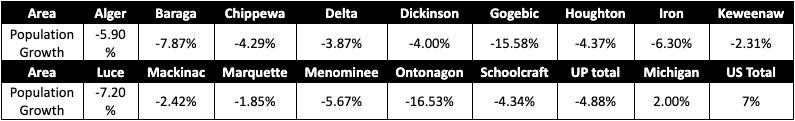

Over the last ten years Michigan as a whole has grown at a rate of about 2%, lower than the aggregate United States which grew 7%, over the same period. The UP however has shrunk by about 5%; Ontonagon seeing the most of this losing about 17% percent of its population in the last 10 years. Marquette has seen the least, only losing about 2%, with the rest of the counties falling in between.

Along with population rates, birth rates are also falling. The US birth rate declined by 10% in the last ten years, the Michigan birth rate has declined about 8% in the same time span. The most affected in the UP was Ontonagon where the birth rate has decreased by about 49%. The least affected has been Dickinson county where it has fallen just 4%, and was the only county that had less of a decline than Michigan, or the United States as a whole. Effectively this means that the UP is seeing a decline in birth rates and a net outward migration stronger than Michigan and the United States, and makes one wonder where it will level off at.

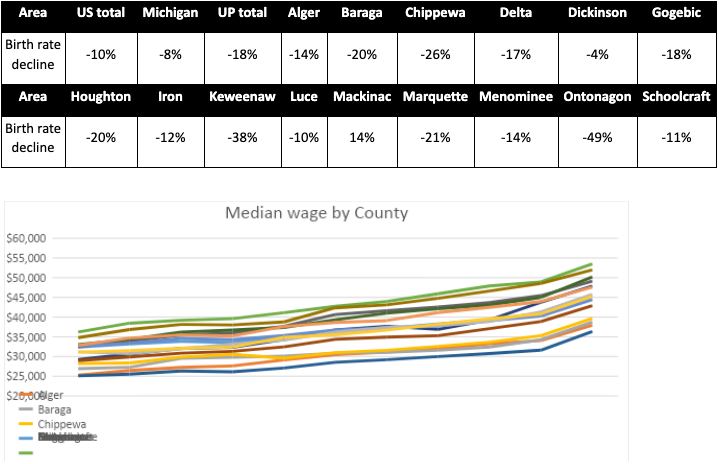

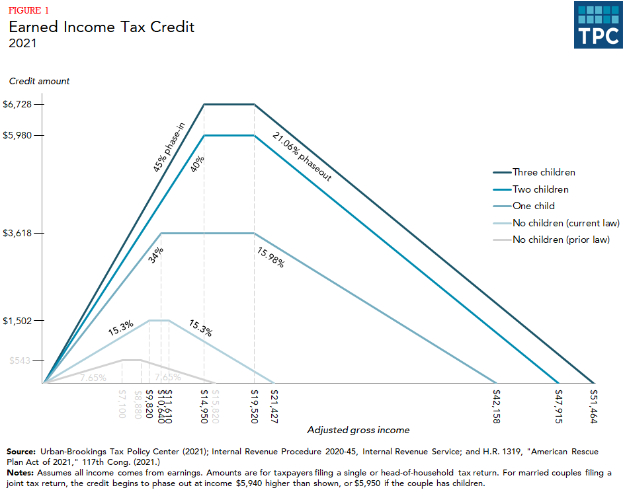

Median income has been rising over the last 10 years, even when accounting for increases in inflation, of which has seen about a 17% increase from 2010-2020 and 23% increase since 2010. Though, only five counties’ personal income grew at a faster rate than the state of Michigan (Alger, Gogebic, Iron, Mackinac, Keweenaw). However every county’s per-capita wage rate grew at a faster pace than the overall US rate. The fastest-growing county was surprisingly Gogebic. While losing the most people, wages grew at a real rate of about 47%; this is compared with a growth across the United states of about 5%, and a Michigan growth rate of about 42%. The lowest growth in wage rate was seen by Marquette county where there was a real growth rate of about 19%. This makes sense, because Marquette has historically had the strongest economy, highest GDP, and most likely the least room for growth of this nature.

EITC is targeted at people who have children and are part of the “working poor” which is defined by the bureau of labor statistics as people who spent at least 27 weeks in the labor force (that is, working or looking for work) but whose incomes still fell below the official poverty line or those that are close to this level. Those who do not have an earned income (income from legal employment), are ineligible to receive this income tax credit.

In a way, the EITC works as a sort of “Negative Income Tax,” a term brought into the vernacular by economist Milton Friedman in the 1960’s (https://mitsloan.mit.edu/ideas-made-to-matter/negative-income-tax-explained#:~:text=The%20idea%20of%20a%20negative,many%20additional%20benefits%2C%20as%20well). The benefits that come from the cash returns are different from those that come with in-kind benefits, things such as housing or food. It allows people to purchase what they feel they need most, which tends to work better, and more efficiently than their in-kind counterparts. (https://www.theatlantic.com/international/archive/2015/09/welfare-reform-direct-cash-poor/407236/)

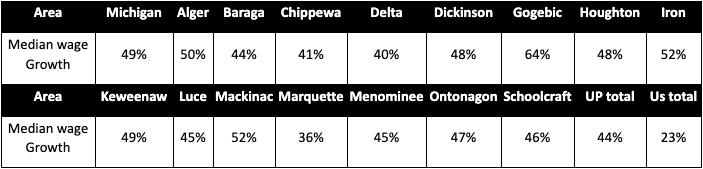

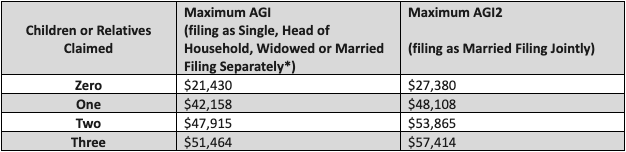

The tax credit is based upon three different factors, the first being the amount of kids that you have either 0, 1, 2, or 3+. How you classify your relationship, single, married, or qualifying widow (single and qualifying widow get the same credit). Finally, income is considered, with each different category having its own minimum and maximum qualifying income. The highest total EITC goes to a couple with three children. However, when looking at proportionality, a single parent with three kids receives the most per-capita.

A household gets increasingly more money back as they earn more money. The incentive starts at zero, and increases as they earn more money eventually plateauing once they hit the minimum full threshold amount. The tax credit stays steady as the household earns more until they reach the maximum earned income plateau threshold, after which, the credit is reduced until they reach the maximum income level. The point where the credit is ends for the highest possible allowance is $57,414 for a married couple with three children.

Due to President Biden’s American Rescue Plan there has been an increase in the credit available to those who are low income but childless. This was seen as a major flaw in the efficacy of EITC, as it was much more geared towards families with children. This is typical of 1970’s-era policies as the demographics of the United States had a higher birth rate, and the growth of the nation was prioritized, and even incentivized. However, America’s demographic make-up has been changing and as we move further into the 21st century this is something that policy makers must realize and adapt to. In the graph above the difference between last year’s tax credit and this year is shown.

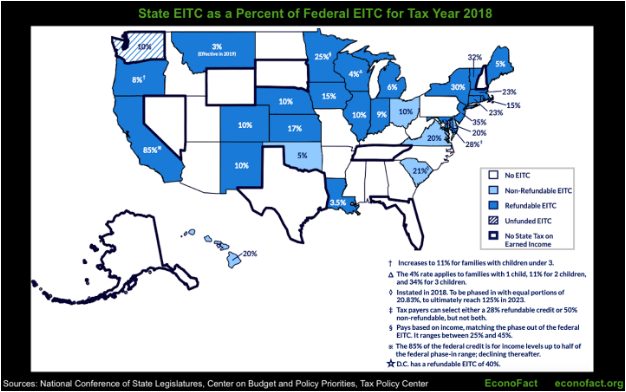

Along with federal EITC, states can also have a version. This is typically a supplement to the federal EITC where each state receives a tax credit equal to a proportion of the federal tax credit. States can use the same classifications for EITC the federal government does, so this makes it fairly straightforward to implement. Michigan does this and their proportional rate is currently at 6% of the federal EITC, though there are proposals to change this. In Michigan, if a married family with 2 children were to receive the maximum credit of $5,980 they would receive that plus a credit of $358.8 on their state income tax.

Not every state offers a state refund for the EITC, but states who choose to do so can set their own levels. Across the US they range from 3% in Montana up to 85% in California. South Carolina is planning on expanding their credit to 125% by 2023, which would make it the top matching state. Some states try to provide support for gaps in what the federal government provides, i.e. people who are filling without kids. Though support in some states may also be given to those with more than 3 kids. All in all, not all states choose to follow the federal guidelines explicitly, but many of the state guidelines are similar to the federals.

The demographics that tend to most use the EITC fall into two main categories, primarily the main recipients are those in urban areas. After that the second most common recipient is someone in a rural area. Those who reside in suburbs tend to not be affected, as these are typically affluent areas. The scope of this paper focuses on those in rural areas such as the UP. As the main determinant of eligibility is income, rural areas tend to be disproportionately affected. This can be due to the lack of opportunities in these rural areas, as well as the higher prevalence of underemployment and informal jobs (such as working for a family member/friend doing under the table work).

Michigan’s Upper Peninsula is highly rural, with the Hancock/Houghton area and the Harvey/Marquette/Ishpeming/Negaunee being two notably non-rural areas, though they tend to be exceptions in the UP. Due to per-capita income levels in the UP typically lower than the nationwide levels (in all counties except Dickinson, Gogebic, Iron, Keweenaw, Mackinac, and Menominee), and lower than the Michigan average in every county except Dickinson, one can expect the amount of EITC payments made to be higher than in other non-rural areas (though still lower than urban areas).

However, all these things aside the UP as a whole still takes in less money per-capita than Michigan does in average per-capita. There are a couple of reasons that this might be, most notably, that the population of poor people in Michigan’s lower peninsula, specifically large urban population centers, must be greater than in the UP. However, for what reason it might be, is beyond the scope of this analysis.; as there will be a focus on how each county relates to Michigan and to the aggregate UP.

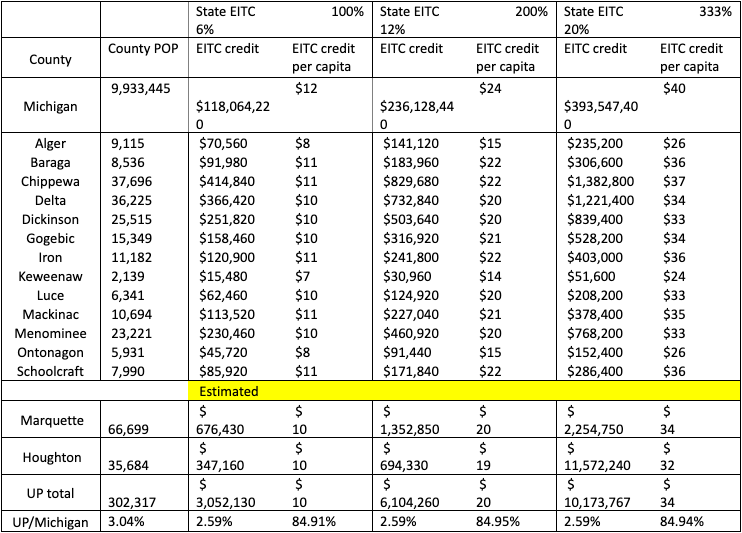

When it comes to the EITC, the UP takes less than the state average in all counties. This results in the UP having about 3% of the state’s population while only taking in about 2.6% of the EITC funds. Which at a 6% state match EITC equates to about 3 million dollars of state money compared to the nearly 120 million that Michigan receives in aggregate every year. Which means the state of Michigan receives about 2 billion dollars every year to fund this tax credit.

Michigan currently has several different undecided proposals in play to increase the EITC match amount, these range from doubling the match to 12%, to tripling it or more. Senator Wayne Schmidt of the eastern UP and upper lower peninsula has proposed an increase up to 30%. This increase would be over three times the current state match of 6%, and would result in Michigan paying around 400 million dollars a year to provide this incentive. Several organizations are moving to support it such as the Small Business Association of Michigan and the Michigan Restaurant and Lodging Association. They believe that due to its nature as a working incentive it might help reduce some of the labor shortage that we are currently seeing (https://www.sbam.org/mi-earned-income-tax-credit-could-climb-to-30/).

Michigan has come out of the pandemic with over a 2 billion dollar surplus and as with any surplus there are many different ideas being thrown around Lansing about how to spend it. One of the proposed ways is through the EITC. Since the EITC is considered to be a successful policy, both by its bipartisan nature and its effectiveness in lifting people out of poverty while encouraging them to work (https://www.cbpp.org/research/federal-tax/the-earned-income-tax-credit#:~:text=In%202018%2C%20the%20EITC%20lifted,people%2C%20including%206.1%20million%20children) it is one of the first policies to be considered when there is extra money in the coffers. In the above table I have detailed some of the costs of Michigan’s increasing of the EITC, and how much it would cost tax-payers, along with individual county costs. For instance, if EITC was doubled, it would cost the state of Michigan 236 million dollars (to match 12% instead of six). The question then becomes is this the best use of taxpayer funds, or are there more efficient solutions to the pressing problems of poverty.

The earned income tax credit is an important one, and an incentive that can truly help people who are struggling across the UP and beyond. There are areas struggling that need assistance to relieve stressed workers and revitalize towns with several proposals floating through the state legislature to do just that. EITC is one that is efficient and where the total cost to taxpayers of the state is small, especially for the benefit it brings, especially considering the tax surplus. All in all, the earned income tax credit is an important incentive that can make a difference.