Dark Store Theory in Michigan’s Upper Peninsula: Impacts and Predictions

Dark store theory refers to a method of property tax assessment that is often applied to big box stores (i.e., Walmart, Meijer, Home Depot, etc.) requiring them to be compared to similar, vacant properties in the same community rather than comparing them to similar stores in other communities or to less similar properties (e.g., smaller, independently-owned stores). Michigan tax law stipulates that property must be assessed through comparisons to similar properties, and the lack of big box stores brought about by the Great Recession, in rural communities especially, has made comparison difficult and led to the use of dark store theory. Big box stores have appealed their taxable value under the argument that they should be compared to similar, vacant properties in the area. The Michigan Tax Tribunal has largely agreed with this argument.

Use of the dark store theory has been contentious across the state, but it has been a big issue in the rural communities of the Upper Peninsula. The following report will examine the use of the dark store theory in Michigan and what state law says about property assessment and taxation. It will also look at the theory’s impact on local governments and property tax revenues in the Upper Peninsula. The losses incurred as a result of tax assessments being lowered due to the dark store theory have limited the services local governments are able to provide to their residents. Finally, the report will look at how the use of the dark store theory affects Michigan businesses: Is it leading to proper assessments of big box stores, or does it raise questions of equity in taxation if smaller, mom and pop stores are being assessed at higher levels? These issues are currently being discussed in the Michigan legislature with both the House and Senate seeing bills proposed that would change how these big box stores are assessed.

Michigan’s Local Property Tax Landscape Post 2008

Michigan houses 1,856 general-purpose local governments, comprised of 83 counties, 276 cities, 257 villages, and 1,240 townships.1 Local governments in Michigan, both general purpose and special purpose, are very reliant on the property tax because it is, largely speaking, the only own-source revenue that these governments have at their disposal. All 276 cities in Michigan can levy an income tax and 24 cities currently collect this tax from residents and nonresidents who live and/or work in the city.2 Many local governments also rely on state revenue sharing, which is distributed through two programs, constitutional revenue sharing and statutory revenue sharing. Constitutional revenue sharing is distributed to local governments per capita, but statutory revenue sharing relies on state appropriations and it has been cut substantially over the last two decades.3

The inherent problems associated with over-reliance on one tax source were highlighted when the nation fell into the Great Recession, which lasted from 2007 through 2009. This recession, which was precipitated by the housing market crash, brought about the most severe economic downturn since the Great Depression. The entire nation was impacted, but Michigan was hit particularly hard due, at least partially, to a decline in the profits of the big three automakers in Detroit and a severe decline in property values across the state. This led to declines in local property tax revenues, which had a large impact on local government budgets. Some local governments across the state have still not completely recovered their taxable property values over 10 years after the end of the recession.4

Up until the Great Recession, property tax revenues were a very reliable source of revenue, but this recession showed that they cannot always be relied on as a stable source of revenue. In addition, property tax revenues do not recover as quickly as other tax revenues (e.g., income, sales) during post-recessionary economic expansions. Declining or slow growing property tax revenues can be exacerbated in local governments also dealing with declining revenues due to dark store property reassessments.

Property Assessment and the Determination of Property Values

An individual taxpayer’s property taxes due will depend on their property value and overall tax rate. The tax rate is the combined rate of all the types of governments that serve that property, including a county; city, village, and/or township; school district; intermediate school district; and any special districts (e.g., library or sewer districts). Taxpayers can also owe ad valorem special assessments, which are not technically taxes, but are levied as additional tax rates against a property’s value.5 Tax rates, as well as limitations on property taxes, are written into the state Constitution and statutory law; they are also included in city charters and rates can be raised (within the limitations written into law) by a vote of the people.

Property values, for both commercial and individual taxpayers, are determined by an annual assessment process codified in state law. State law allows property assessment to be done at the county level or the city or township level. The state Constitution requires that real and tangible personal property be uniformly assessed at 50 percent of true cash value, which equates to a property’s state equalized value (SEV). The Constitution also requires that the state legislature provide for a system of equalization of assessments to minimize variations caused by subjective input from local assessors.6

The passage of Proposal A in 1994 changed the property assessment process by instituting a modified acquisition value system. Property is still assessed based on true cash value (SEV), but since 1995 rates have been levied on taxable value (TV), which limits increases in property values to inflation or five percent, whichever is lower, until property is sold.7 At the point of sale, property reverts back to SEV. Proposal A also led to property being classified as homestead (i.e., a Michigan resident’s home) or non-homestead (includes business property, rental property, and vacation homes). Non-homestead property can be assessed additional taxes to fund school operations.8

Taxes owed are calculated by multiplying the TV of a property by the millage rate levied by the local unit. Local governments cannot levy more than their authorized millage rate based on charter and/or state law. A taxpayer’s total tax rate is the combination of the rates of all the governments it pays property taxes to, including the state, which levies a 6.0 mill state education property tax.

Example: Taxable Value x Total Millage Rate = Property Tax Bill Amount9

The assessment process allows for an appeal process, which is referred to as a valuation appeal and takes places before the Michigan Tax Tribunal. Valuation appeals must be filed before May 31st of the tax year for residential properties and July 31st for non-residential properties. Small claims appeal petitions are submitted online, generally by the property-owner, and can usually be settled quickly by an administrative law judge. Appeals that deal with larger residential or commercial claims are settled with an entire tribunal hearing, which can take months or even years to complete (see box on Michigan Tax Tribunal).

The Dark Store Theory in Michigan

During the Great Recession, many big box stores and shopping malls were shuttered and became vacant properties. Once vacant, these properties possess little market value and are rarely repurposed by other retailers because of deed restrictions placed by the former owners. Deed restrictions are often placed on big box properties to limit commercial competition by preventing other companies from opening retail fronts. Due to a lack of demand for vacant retail properties, they often sell at a fraction of their market value based on when they housed active businesses. Once the economy began improving after the Great Recession, big box retailers (e.g., Walmart, Menards, Meijer, etc.) built new stores rather than repurpose the old ones. The dark store theory was born out of this process of old retailers leaving abandoned buildings with little market value and new retailers building new buildings rather than take over the abandoned buildings.

Following the completion of a new store in Michigan, the city, township, or county that the store is located in is responsible for determining the true cash value of that property in accordance with the General Property Tax Act of 1893.10 This value is required by law to be determined by comparing the selling prices of similar properties in the area.11 This system is generally effective in determining the values of most residential properties due to a large pool of sales to sample, but it becomes much more complicated with large retail properties like big box stores that do not have many comparable properties in a county/area. Local governments assess new big box stores by comparing them to similar properties that feature active storefronts rather than comparing them to the vacant buildings left by previous retailers. In rural areas, this process often involves assessing properties that are outside of unit’s municipality or county.12

Big box retailers have appealed the assessed values of their properties on the basis that counties have used irregular methods to appraise them. The Michigan Tax Tribunal has jurisdiction of these appeals and has decided in favor of the big box retailers based on the assessment process and standards written into Michigan law, namely that local governments are responsible for determining value based on recent local property sales. This has led to large decreases in commercial property tax revenues for some local governments across Michigan.

In Michigan and other states, the dark store theory has been especially detrimental to rural areas, which possess less diversified pools of retailers to base assessments on. Urban areas have a greater variety of retail properties which local governments can use to assess the value of new locations. However, a new store in a rural community may not have any other comparable properties within the same county. Furthermore, rural areas have a less diversified tax base and are usually more dependent on the tax dollars from one or two big box retailers within their jurisdiction. With a few exceptions, the majority of Michigan’s dark store appeals have occurred in the rural northern portion of the state.13

Upper Peninsula Counties and the Dark Store Theory

The dark store theory has had a particularly harmful effect in a number of rural counties in the Upper Peninsula. This paper takes a close look at five of those counties and their experience with property tax revenues and dark store appeals.

Chippewa County

Chippewa County is a general law county with a five-member board of commissioners, elected by district to two-year terms. It had a 2019 population estimate of 37,349 and is made up of one city, one village, sixteen townships, and seven school districts. The county levies a current millage rate of approximately 8.7 mills.14 County residents pay the county property tax millage rate, as well as millages to their city, village, and/or township; school district and intermediate school district; and any other special district or authority.

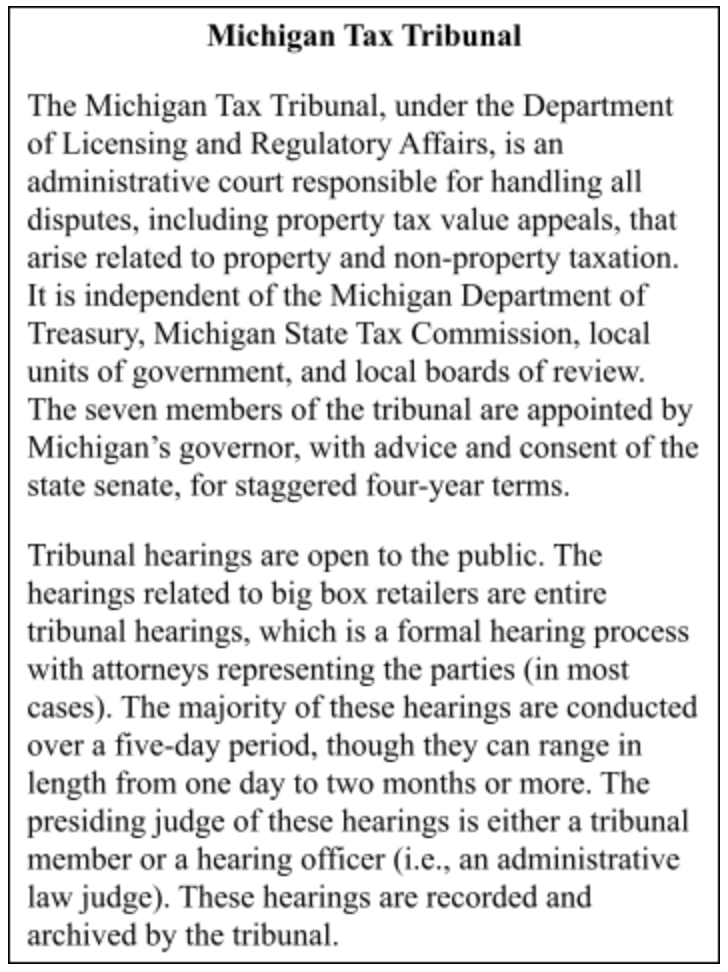

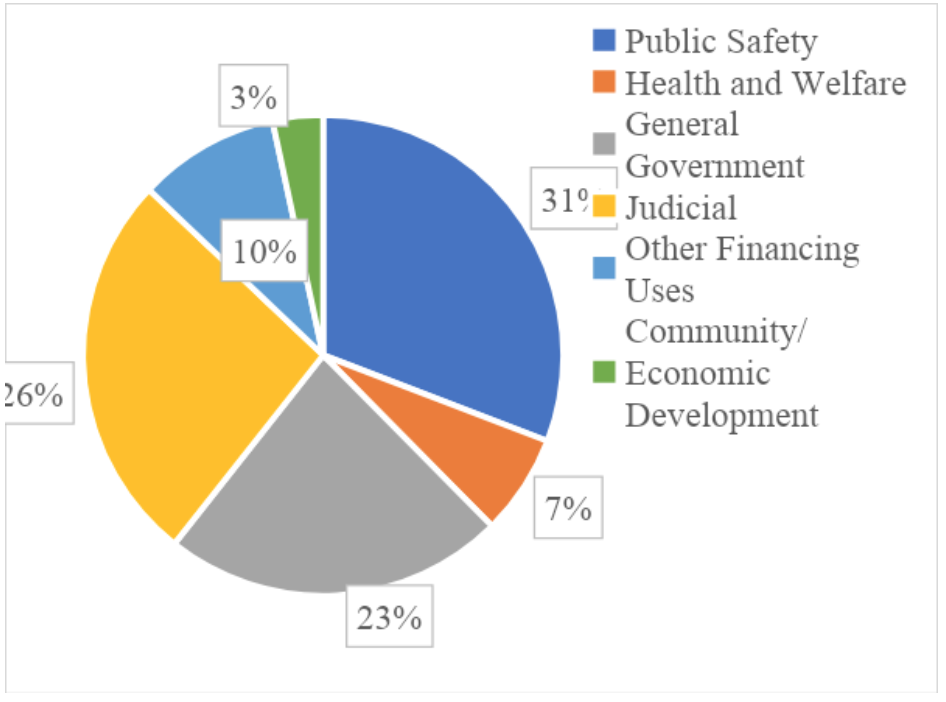

General Fund Budget. Chippewa County’s total general fund revenue in 2019 was $13.5 million with 61 percent of that total made up of property tax revenue (see Figure 1). The other major sources of revenue include state grants (11 percent), which includes state revenue sharing, and service charges (15 percent). The county’s total general fund expenditures in 2019 was $13.5 million as well, with the largest portion of the budget going to public safety costs (34 percent). In addition, general government (23 percent) and judicial (22 percent) expenditures made up a large portion of the county budget.

Figure 1: Chippewa County General Fund Revenues and Expenditures, 2019

Source: State of Michigan County Financial Dashboard, Chippewa County Revenues, 2019

Dark Store Theory in Practice. Chippewa County has been through two significant Tax Tribunal appeals filed by big box stores in the last decade. These appeals have had a substantial negative effect on the budgets of both the county and the city of Sault Ste. Marie.

Case One: Walgreen Company v. City of Sault Ste. Marie (2015)15

The Walgreen Company filed a dispute for the 2010 through 2013 tax years alleging that Sault Ste. Marie assessed the values of their property too high. According to the original petition, the over-valuation resulted from clerical errors on the part of the company and assessment processes that violated Michigan case law and tax statutes.16 After siding with the company on account of Michigan statutory law, the Tax Tribunal lowered the property’s TV by approximately $10,000 per disputed year for a total of over $42,000. Chippewa County and Sault Ste. Marie were ordered to refund the tax revenue collected from the over-assessments for the four tax years in question.

Case Two: Wal-Mart Real Estate Business Trust v. City of Sault Ste. Marie (2020)17

Wal-Mart filed an entire tribunal dispute for the 2020 tax year, stating that they had been discriminated against by the city for their big-box status and had been assessed unlawfully high. The company, in their petition, proposed new values “based on the guidelines laid out in Michigan’s Constitution.” The tribunal granted Wal-Mart’s request for consent judgement. The property’s TV was lowered from $5.7 million to $2.9 million. The tribunal ordered Sault Ste. Marie and Chippewa County to refund any taxes that had been collected on the over-assessment.

The Chippewa County Board of Commissioners allocated a portion of the 2020 county budget to the city’s defense in the Wal-Mart dispute. Members of the board have spoken out stating that the refund issued to the company is “unfair” to locally-owned businesses in Chippewa County that do not have the resources to file similar appeals.18 The county has issued approximately $25,000 in refunds between the two plaintiffs in the above cases.

Delta County

Delta County is a general law county and is governed by a five-member board of commissioners, elected by district to two-year terms. It had a 2019 population estimate of 35,784 and includes two cities, one village, fourteen townships, and five school districts. The county levies a current millage rate of approximately 8.1 mills.

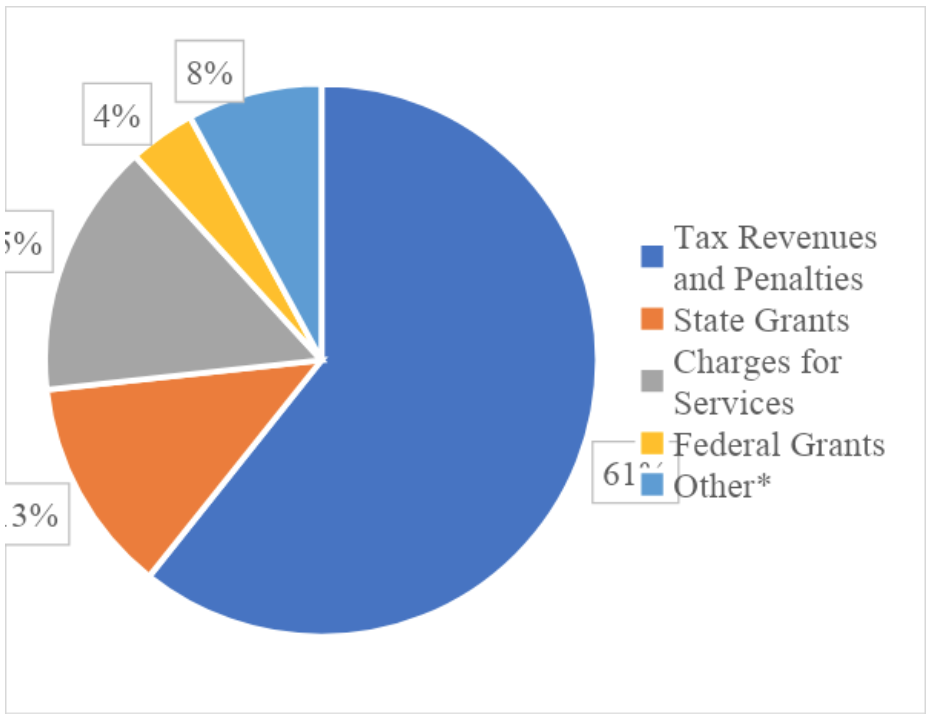

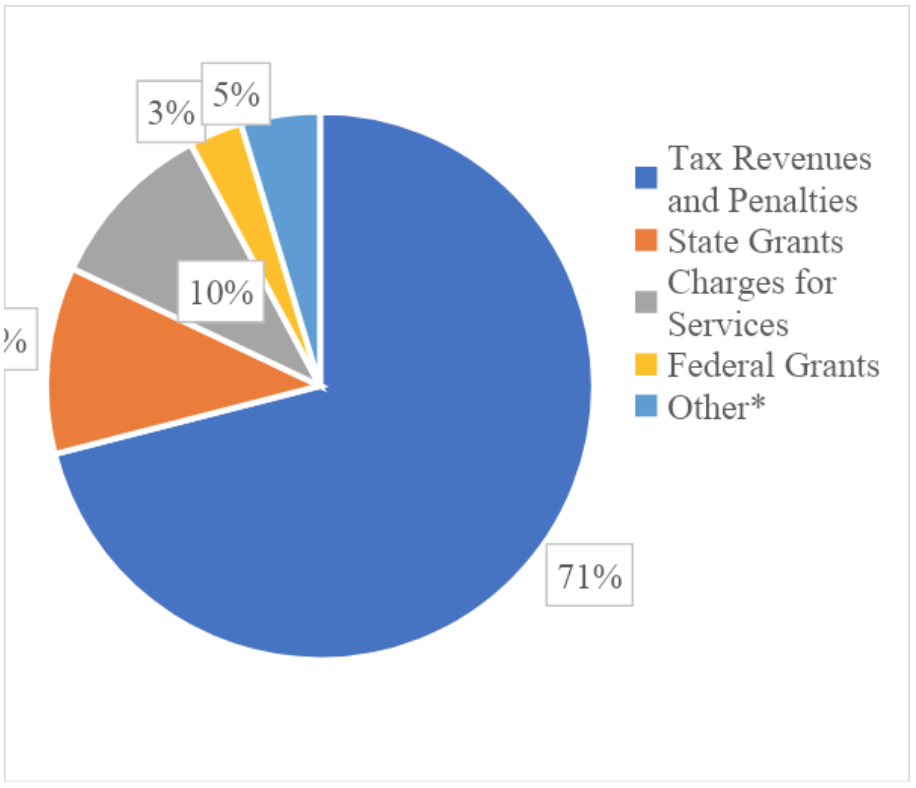

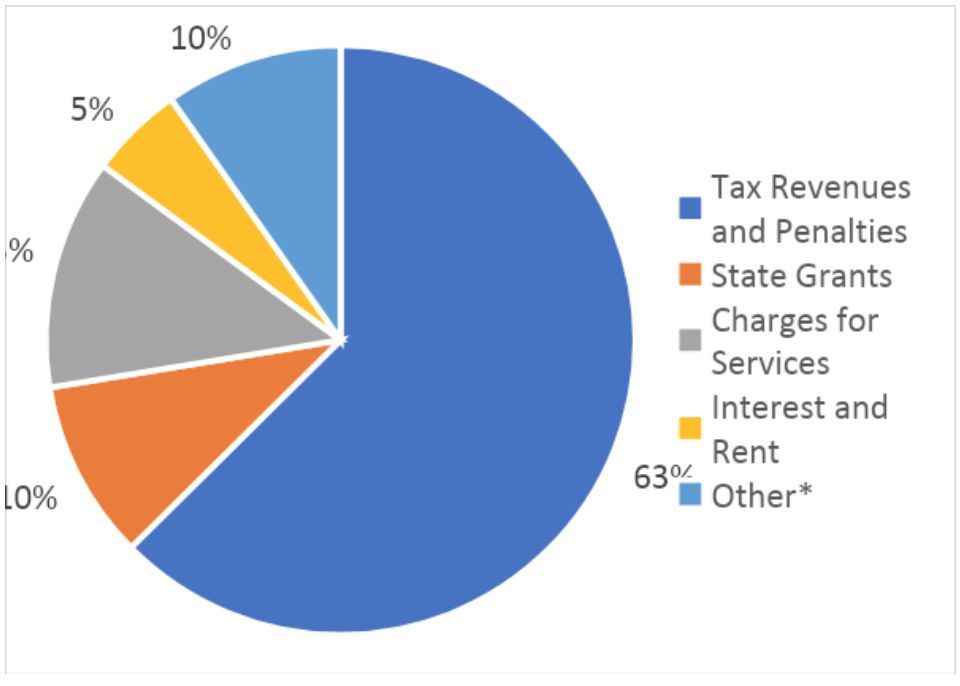

General Fund Budget. Delta County’s total general fund revenue for 2019 was $11.0 million. Figure 2 shows that property taxes made up 68 percent of the total, making it the largest source of revenue for the county. The other big sources of revenue are state grants and revenue sharing (13 percent) and charges for services (10 percent). The county’s general fund expenditures for 2019 totaled $10.6 million with public safety making up 31 percent of the total. Other big-ticket items in the budget include general government expenditures (23 percent) and judicial costs (26 percent).

Figure 2: Delta County General Fund Revenues and Expenditures, 2019

Source: State of Michigan County Financial Dashboard, Dickinson County Revenues and Expenditures, 2019

Dark Store Theory in Practice. Delta County has experienced two significant Tax Tribunal appeals filed by big-box stores in the last five years; both with significant impacts on the budgets of Delta County and the City of Escanaba. The most recent of these cases has garnered statewide attention and gone to the State Supreme Court.

Case One: Walgreen Company v. City of Escanaba (2015)19

Walgreen filed a dispute for the 2010 through 2013 tax years alleging that the city had assessed their property too high due to clerical errors on the part of the company and unlawful assessment practices by the city. Walgreen claimed this violated Michigan’s case law, constitutional guidelines, and the General Tax Act.20 The tribunal sided with the company and lowered the property’s TV by approximately $10,000 per year for a total of around $40,000. Delta County and Escanaba were ordered to refund any taxes collected from the over-assessment.

Case Two: Menard, Inc. v. Escanaba (2020)21

Menard filed a dispute for the tax years of 2012 through 2014. In the original petition, the company alleged that Escanaba’s assessment of their property did not abide by the uniformity requirements of the General Property Tax Act of 1893, which requires that properties be assessed uniformly in accordance to their classification. The company won and the Tax Tribunal lowered the TV by $6.8 million total for the three years. Delta County and Escanaba were ordered to refund the tax collected on the over-assessment.

The city appealed to the Michigan Supreme Court on the grounds that they were refused the ability to present evidence in the original case. The Supreme Court reversed the decision of the Tax Tribunal and ordered a new hearing in the tribunal where both the company and city would be allowed to present additional evidence. The tribunal issued their final decision in May 2020. The tribunal stated that due to the property’s design it did not have the potential to sell at a comparable price to the properties the city had used to assess the store. The tribunal lowered the TV of the property by approximately $2.1 million for each of the three years for a total reduction of $6.2 million. Additionally, the tribunal ordered the county and city to refund the wrongfully collected taxes. Escanaba has since filed a motion for appeal with the county’s support.

Local government units in Delta County have expressed concern over the mounting dark store issue. Menard v. Escanaba resulted in refunds from, and reduced revenue for, the county, city, public schools, and a community college. Delta County has issued approximately $55,000 in refunds to companies as a result of the above cases. Additionally, Menard, Inc. reportedly collected $421,000 in refunds from various units in Delta County.22

Dickinson County

Dickinson County is located in the southern part of the Upper Peninsula with a 2019 population estimate of 25,239. The county includes three cities, seven townships, and five public school districts, and levies a current millage rate of approximately 9.9 mills.

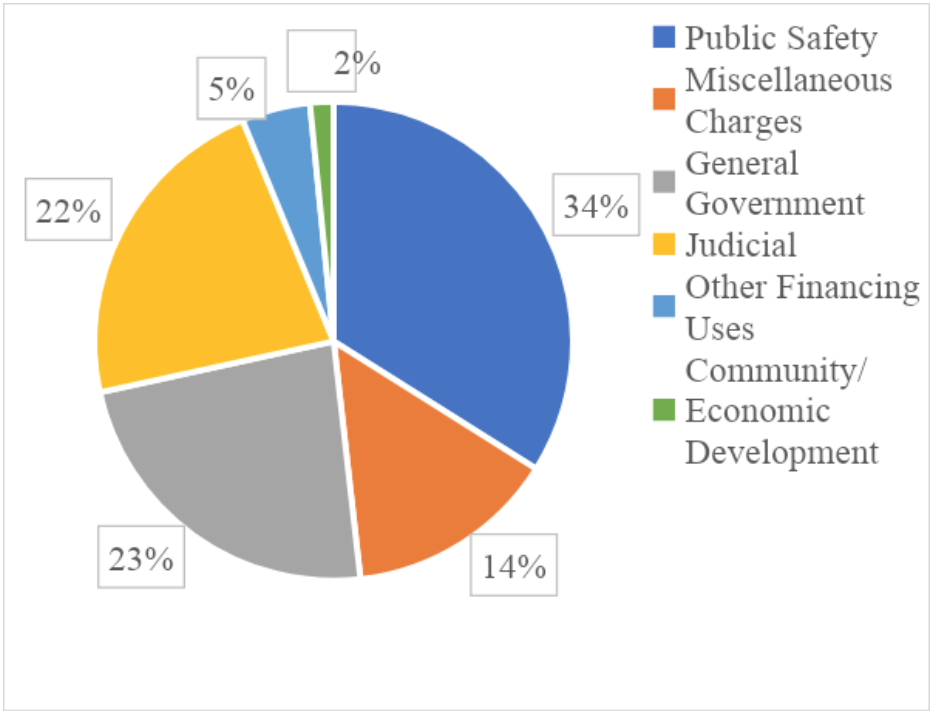

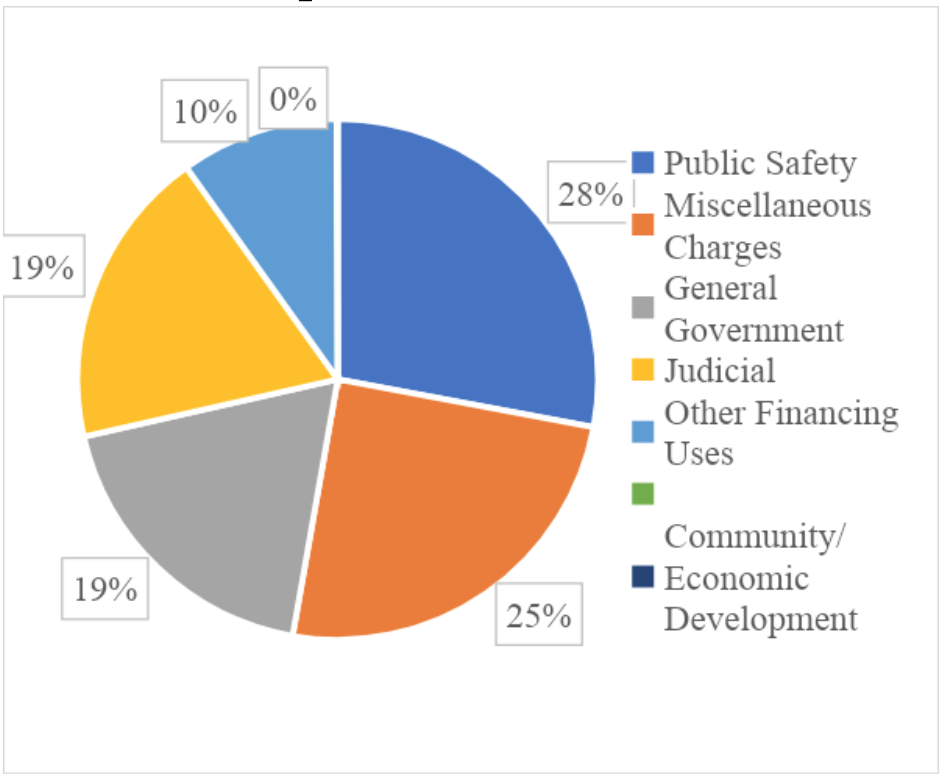

General Fund Budget. Dickinson County’s total general fund revenue for 2019 was $10.0 million. Figure 3 shows that that over 70 percent of that revenue comes from property taxes, making them critical to the county’s ability to provide services. Additionally, charges for services and state grants provide 10 and 11 percent of total revenues respectively. Dickinson County’s 2019 general fund expenditures totaled $9.2 million. The largest portion of the budget went to public safety services (28 percent); however, costs were generally spread across public safety, general government, judicial, and miscellaneous charges.

Figure 3: Dickinson County General Fund Revenues and Expenditures, 2019

Source: State of Michigan County Financial Dashboard, Delta County Revenues and Expenditures, 2019

Dark Store Theory in Practice. Dickinson County has been through three tribunal appeals filed by big-box stores against different communities within the county in the last decade. These appeals have had a substantial impact on the county’s budget, as well as the budgets of the impacted cities and townships.

Case One: Walgreen Company v. City of Iron Mountain (2014)23

The Walgreen Company filed a dispute with the Michigan Tax Tribunal for tax years 2010 through 2013, alleging that their property had been assigned a TV that was too high for all four years. The company blamed both inaccurate city assessment practices and clerical errors on their own part for the over-valuation. Additionally, the company presented new proposed TVs for the years based on the application of Michigan case law24 and the General Property Tax Act of 1893.25 The Tax Tribunal decided in favor of Walgreen Company, stating that the company’s proposed values were in line with Michigan property tax law. The tribunal lowered the TV for the location approximately $10,000 per year, totaling about $42,500 for the four years. Dickinson County and Iron Mountain were ordered to refund the taxes that were wrongfully collected in those years.26

Case Two: Home Depot USA, Inc. v. Township of Breitung (2015)27

Home Depot filed a complaint stating that Breitung Township assessed the value of its property too high in 2014 and 2015 due to an error on the part of the township. The company stated that their property had been assessed based on other properties that were not comparable in violation of Michigan’s Constitution and state law. The Tax Tribunal held a pre-hearing conference and the township and Home Depot entered into a consent judgement agreement, which was proposed by the company and agreed to by the township in order to avoid a hearing. This confirmed that the TV for the years should be lowered by $3.2 million, approximately $1.6 million per year. The county and township were ordered to refund the wrongfully collected taxes for 2014 and 2015.

Case Three: Wal-Mart Stores, Inc. v. City of Iron Mountain (2020)28

Wal-Mart filed a dispute against Iron Mountain for the 2019 tax year claiming that the city had discriminated against them based on their big-box status and had assessed two of their properties unlawfully high. The company went on to propose new TVs based on its interpretation of the Michigan Constitution and statutory law. The Tax Tribunal allowed the city and Wal-Mart to enter a consent judgement, which lowered Wal-Mart’s property value by approximately $700,000. The county and city were ordered to refund the wrongfully collected taxes for 2019 in accordance with the General Property Tax Act.

The summative TV reductions from these three cases resulted in an approximate $40,000 of refunds issued from Dickinson County, in addition to refunds from the local governments. Additionally, these cases have resulted in a reduced revenue in coming years for the county and the affected local governments.

Houghton County

Houghton County is a general law county with a 2019 population estimate of 35,784. It is made up of two cities, fourteen townships, and ten school districts. The county levies a current millage rate of approximately 10.4 mills.

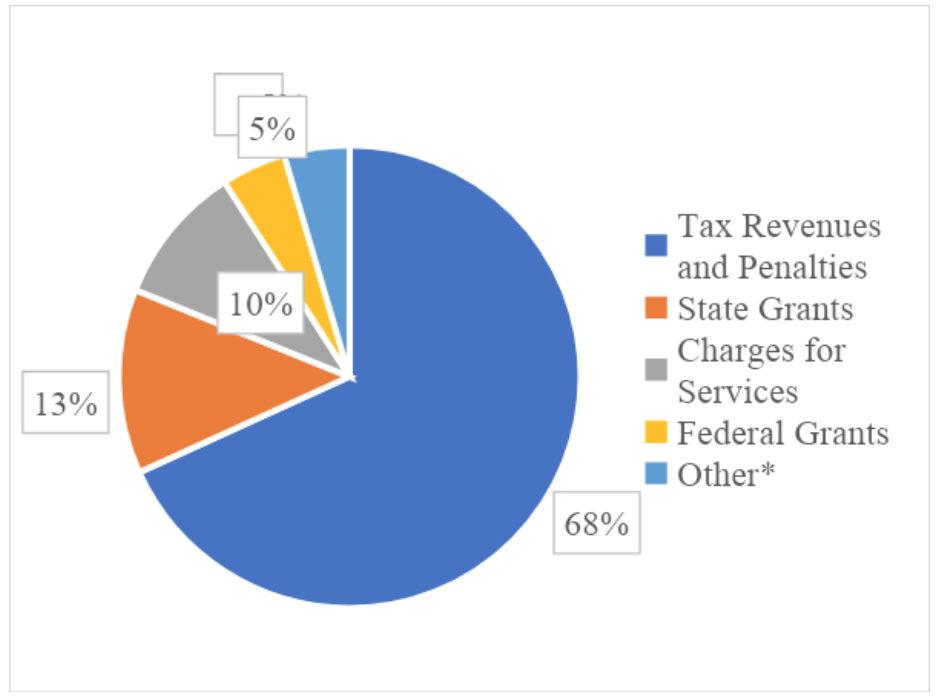

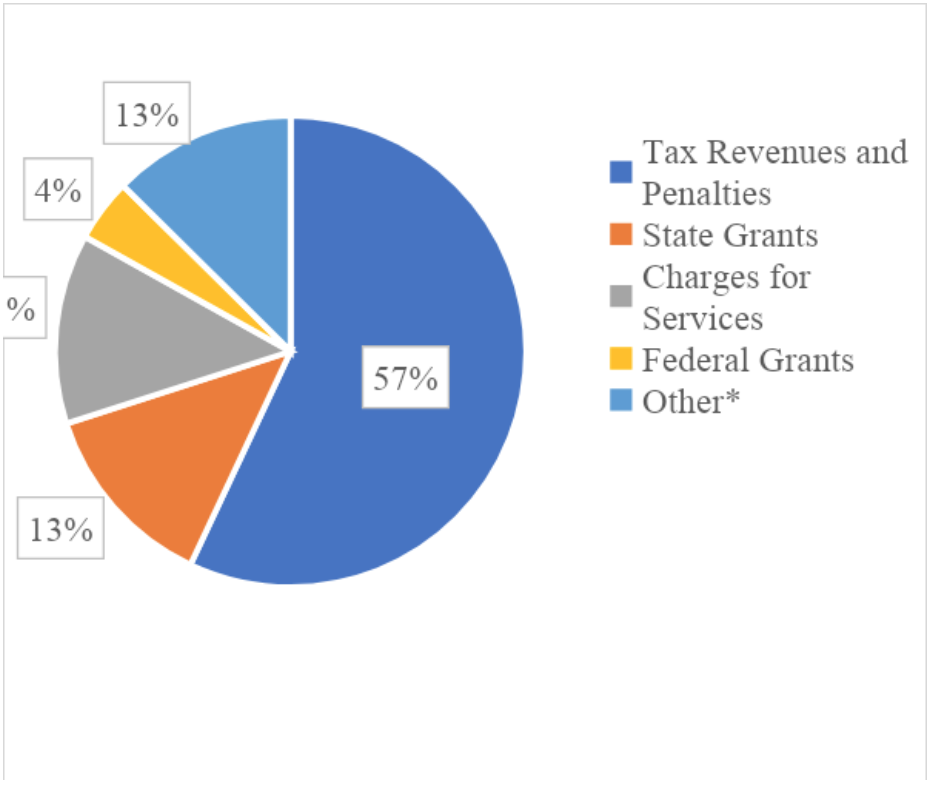

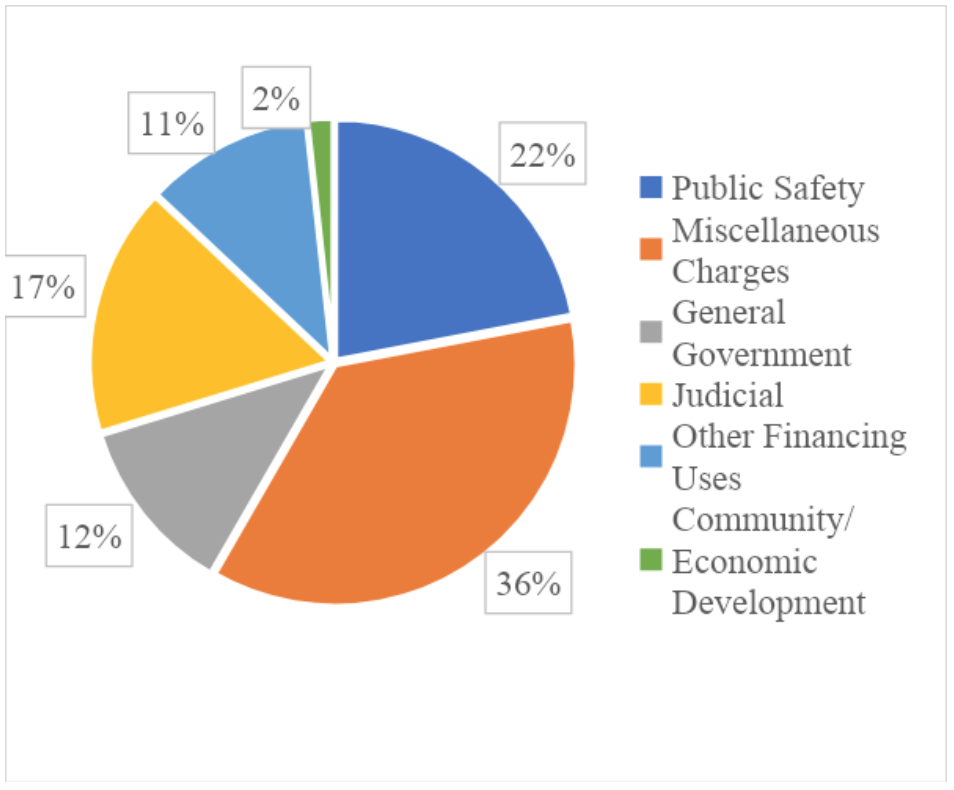

General Fund Budget. Houghton County’s total general fund revenue for 2019 was $10.6 million. Figure 4 highlights the county’s revenues and expenditures; the largest source of revenue for Houghton County’s general fund comes from property taxes (57 percent). Additionally, the county gets revenue from state revenue sharing and grants (13 percent) and charges for services (13 percent). Houghton County’s general fund expenditures for 2019 totaled $10.7 million with miscellaneous charges making up the largest cost (36 percent). Other big costs include public safety (22 percent) and judicial (17 percent).

Figure 4: Houghton County General Fund Revenues and Expenditures, 2019

Source: State of Michigan County Financial Dashboard, Houghton County Revenue, 2019

Dark Store Theory in Practice. Houghton County has had one significant Tax Tribunal appeal in the last decade. The appeal is currently ongoing.

Case One: Walmart Stores East, LP v. City of Houghton (2020)29

Walmart filed a dispute in 2018 stating that their Houghton store had been assigned a TV that was an unconstitutionally high in comparison to its true cash value for that year. Both the city and company have since requested to submit additional evidence for their case. Walmart has included their TVs for the 2019 and 2018 tax years, requesting that each year be lowered by approximately $700,000. The Tax Tribunal has placed the case on the docket list for March of 2021.

The city and county have expressed commitment to pursuing this case to make changes to the dark store theory and its success in lowering TVs of big box retailers.30 The potential $1.4 million reduction in the TV of Walmart’s property could result in a $15,000 refund to the company from the county alone. The potential loss of revenue for the township and the county in this case could amount to a significant reduction in their budgets over time.

Marquette County

Marquette County is a general law county with a 2019 population estimate of 66,699.31 The county contains three cities, nineteen townships, and nine public school districts, and levies a current millage rate of approximately 7.6 mills.

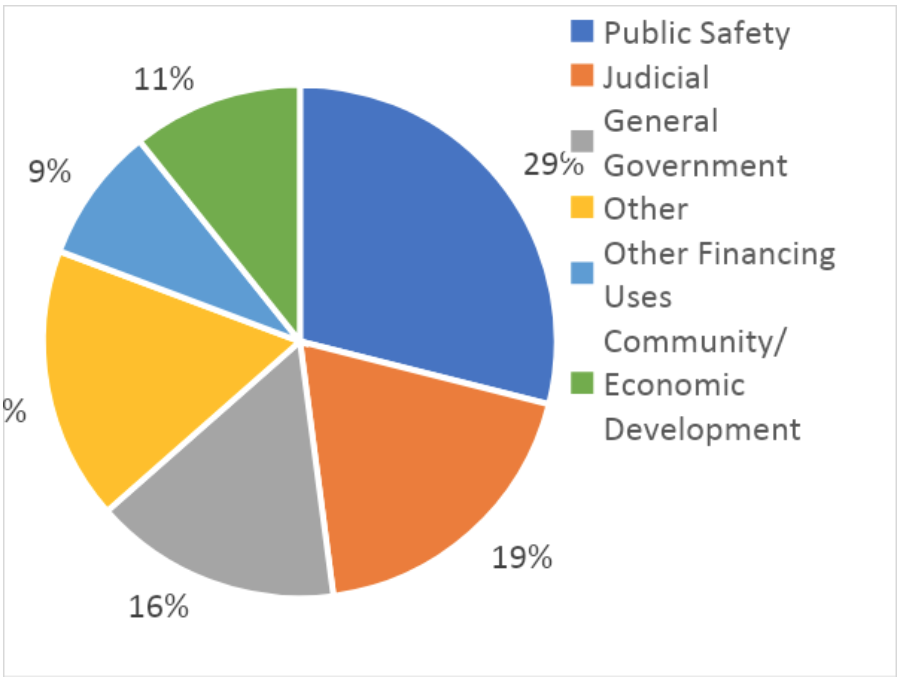

General Fund Budget. Marquette County’s total general fund revenue for 2019 was $26.3 million. Figure 5 shows that the largest source of revenue for Marquette County’s general fund comes from property taxes (62 percent). Additionally, the county gets revenue from charges for services (13 percent) and state revenue sharing and grants (10 percent). Marquette County’s general fund expenditures for 2019 totaled $22.1 million with public safety making up the largest cost (29 percent). Other big costs include other judicial (19 percent), other uses (17 percent), and general government (16 percent).

Figure 5: Marquette County General Fund Revenues and Expenditures, 2019

Source: State of Michigan County Financial Dashboard, Marquette County Revenues and Expenditures, 2019.

Dark Store Theory in Practice. Marquette County has been through three significant tribunal appeals filed by big-box stores against different communities within the county in the last five years. However, Marquette has experienced multiple appeals from different companies since 2010. These appeals have made a substantial mark on the county’s budget, as well as affecting the budgets of the impacted cities and townships.

Case One: Lowe’s Home Center, Inc. v. Township of Marquette (2014)

Lowe’s filed a dispute on account of an ad valoreum special taxation related to its big-box status and location for 2010, 2011, and 2012. The store had been charged an additional fee on top of its standard tax bill given its placement in a district near a public library in Marquette. The attorney representing the store notably pointed to the income potential of similar locations to convince the tribunal of the inequity of the additional fee. Both the Tribunal and Court of Appeals sided with Lowe’s, requiring a refund from the township and county and limiting the operating hours of the public library.

Case Two: Target Corporation v. Marquette Township (2015)

Target filed dispute for the TV for the 2014 and 2015 tax years alleging that the township had assessed their property unconstitutionally high. The company proposed new, lower values based on their interpretations of the Michigan Constitution and corresponding tax statutes. The Tax Tribunal sided with Target and accepted their proposed TVs. This lowered the TV of the property by approximately $1.2 million per year for a total of $2.4 million. The Tribunal ordered Marquette Township and County to refund the company for any tax collected from the over-assessment.

Case Three: Wal-Mart Real Estate Business Trust v. Township of Marquette (2020)

Walmart filed a dispute for the TV of their Marquette property for the 2020 tax year. The company alleged that their assessment exceeded the amount allowed by the Michigan Constitution and other tax statutes. The Tax Tribunal set the disputes hearing for July of 2021. If Walmart wins, the TV of their property will be reduced by approximately $2.5 million.

Case Four: Meijer, Inc. v. Township of Marquette (2020)

Meijer filed a dispute for the 2020 TV of their Marquette store alleging that the township had assessed their property unconstitutionally high. The company stated their property was assessed outside of the uniform standards of other commercial locations in the township. The Tax Tribunal has scheduled the pre-hearing conference for the case in June 2021. If the company wins the case the 2020 TV would be reduced by approximately $3.1 million.

Marquette Township has reported a loss in revenue totaling $1.2 million in the last decade. The township went on to report that over $300,000 dollars had been removed from operating funds for both the county and township. Additionally, the funding for special education service, fire department, road millage, county dispatch, and public library have all been reduced a direct result of dark store appeals.32

State Laws and Dark Store Theory

Current state law related to assessing and dark store practices requires assessing units to use comparable properties when determining property values. Comparable properties have been defined as similar types of property within the same governmental unit or county. Rural governments, like those in the Upper Peninsula, have not had comparable properties in their own units and this has led the big box stores, and ultimately the Michigan Tax Tribunal, to question the value local assessors have attached to these properties. Big box stores have instead been compared to similar vacant buildings rather than to other retail establishments in the area (e.g., local businesses that are not big box retailers) and this has led to lower property values for the big box stores.

Many states have begun to address the dark store issue legislatively. In early 2020, the New York State Assembly passed a bill to clarify assessment practices for commercial properties. The New York legislation stipulates that assessment must be based on similar properties that are being used in the same way as the property being assessed. The law elaborates that these properties must be contained within the state, but do not need to be in the same district as those to be assessed. The significant change in the bill was the need for comparable use, meaning that big box stores must be assessed based on properties of a similar size which are actively being used as retail locations.33 Similar legislation has been proposed in Wisconsin, North Carolina, and Indiana. By providing specific and clear guidelines to local assessors, it creates less confusion for property owners and local assessors than the previous law did. This increased clarity has the desired result of reducing instances of commercial property value disputes as well as the loss of local revenue.

Some policymakers in Michigan have taken steps to pass a similar law at the state level.

Current Michigan Legislative Efforts. In January of 2019 Senate Bill No. 26 and House Bill No. 4025 were introduced in the Michigan Legislature with the stated purpose of amending the 1973 Tax Tribunal Act, which established the tribunal and the standard procedures for tax appeals.34 SB 26 and HB 4025 aim to add a new section to the Tax Tribunal Act that would include several ruling guidelines to the Tax Tribunal’s decision process in entire tribunal appeals.

The first guideline would require the tribunal to consider the current market that the property is competing in, including the supply and demand for the property, as well as the current and potential uses of the property. The tribunal would also need to consider the “highest and best” use of the property in question and other comparable properties in the competing market. This stipulation would require the earning potential of a given store to be considered in determining TV; additionally, the cost of construction and age of a property must be considered.

The second guideline stipulates that vacant properties may only be used to assess occupied properties under specific circumstances, such as the vacant property must have been recently vacated and under normal circumstances for the current market. Additionally, the property must have become vacant after operating in the same use as the disputed property. Properties that have been vacant for long periods and were vacated under different market conditions (e.g., the Great Recession) cannot be used for comparison in determining values of currently occupied properties.

These bills are currently under review by their respective committees. The stipulations they include could potentially streamline and clarify the assessment process for local units as they relate to big box retailers. With the specified assessment instructions, local assessors would be enabled to standardize their methods. This, in turn, would result in fewer appeals from commercial property owners. The reduction in appeals limits the cost incurred by both businesses and local governments from legal costs.

The legislation would undoubtedly result in a benefit for local governments. The detrimental effects of dark store practices would largely be eliminated by this legislation. As reflected in the case studies on counties in the Upper Peninsula, local governments have lost significant portions of their revenues and incurred refund costs as a result of commercial property tax appeals. However, should the bills pass, assessment bodies will be aware of what considerations the tribunal will take when a property’s value is appealed. Additionally, the legislation would limit the ability of big box retailers to compare their values to vacant stores in their community. The Michigan Municipal League and local units across the state have expressed support for the legislation.35

The bills propose a significant change to the State Constitution and established tax code. The bill aims to shift the standard assessment practices by compelling assessors and the Tax Tribunal to consider the potential use of a property in its value. Small business owners are concerned along with big-box stores about this change. Market-based assessment practices have been the state standard consistently since the establishment of the General Property Tax Act in 1893.36 Small and large business alike are classified as “commercial real” for property taxation purposes. Given that the terms surrounding a potential use-based model are vague in the proposed legislation, small business-owners may see an increase to their tax bills as an unintended consequence. This is an issue that could be resolved by eliminating the “potential use” clause from the bills or establishing a separate legislative initiative to address the income loss incurred by dark store theory.

Conclusion

As reflected in the above case studies, the dark store theory details the property landscape in Michigan’s Upper Peninsula. The issue has caused losses in revenue and increased costs for local governments. The result of these practices has decreased access to locally funded programs and services to residents who continue to pay their property taxes. Taxpayers and local governments are understandably frustrated with big box tax decreases.

Some Michigan legislators have aimed to close the dark store loophole through a targeted change to property assessment practices. From the perspective of communities losing revenue, large retail locations utilize police and other public services and need to fairly compensate local governments. While the bills would certainly improve the outlook for these governments, they are not without criticism. Groups advocating for retail businesses, such as the Michigan Retailers Association, have stated that the proposed legislation would create an unfair assessment process for properties that lose value over time. Additionally, the vague terms surrounding a potential use assessment guideline is concerning business owners.

Given these disagreements, it is not clear whether this legislation will pass at this time. Until the legislature creates a policy solution to this issue, the standard in dark store appeals will default to the precedent set by the Tax Tribunal, which has generally sided with lowered TV for big-box stores. Undoubtedly, the negative effects of dark store theory will continue to be experienced by rural communities.

Sources

1United States Census Bureau, 2017 Census of Local Governments: Michigan, 2017.

2Michigan Compiled Laws (MCL) 141.501-141.787.

3Michigan Department of Treasury. “Local Government Revenue Sharing,” 2019. https://www.michigan.gov/treasury/0,4679,7-121-1751_2197—,00.html. (cite CRC state rev sharing report, 2015, https://crcmich.org/publications/reforming_michigan_statutory_state_revenue_sharing).

4“Will Property Taxes Be Immune to the Effects of COVID-19?” Citizens Research Council of Michigan, 2020. https://crcmich.org/will-property-taxes-be-immune-to-the-effects-of-covid-19.

5See Citizens Research Council’s Report 407 – A Distinction without a Difference: Ad Valorem Special Assessments and Property Taxes, June 2019, for more information on these assessments and how they are similar to, and different from, property taxes (https://crcmich.org/publications/a-distinction-without-a-difference-ad-valorem-special-assessments-and-property-taxes).

6The General Property Tax Act (1893). Michigan Constitution, Article IX: Finance and Taxation (1963)

7Property values have been held to inflation since 1994 because it has not been higher than five percent.

8Office of Revenue and Tax Analysis, School Finance Reform in Michigan: A Retrospective, 2002.

9https://www.michigan.gov/taxtrib/0,4677,7-187-25923-126336–,00.html

10MCL 211.1-211.157.

11MCL 211.27.

13https://www.mml.org/advocacy/dark-stores/

14One mill is equivalent to $1 of tax for every $1000 of taxable value. For example, the owner of a property with a TV of $100,000 in Dickinson County would owe $989.03 in county property taxes for 2019.

15Tax Tribunal Court Documents on Walgreen: https://taxdocketlookup.apps.lara.state.mi.us/Details.aspx?PK=100797

16Ford Motor Company v. City of Woodhaven, 475 Mich 415 (2006)

General Property Tax Act of 1893:

http://www.legislature.mi.gov/(S(ygfzfsitbmmfmkxbkddyqz5d))/mileg.aspx?page=getObject&objectName=mcl-Act-206-of-1893

17Michigan Constitution Article IX: Finance and Taxation:

http://www.legislature.mi.gov/(S(gvlw1mw21iwgzgu4shecvz54))/mileg.aspx?page=getObject&objectName=mcl-Constitution-IX

18Statement from Chippewa County Board of Commissioners:

https://www.sooeveningnews.com/news/20200714/tax-loophole-theory-costing-michigan-communities-thousands-in-lost-revenue

19Tax Tribunal Court Documents on Walgreen: https://taxdocketlookup.apps.lara.state.mi.us/Details.aspx?PK=100744

20Ford Motor Company v. City of Woodhaven, 475 Mich 415 (2006) General Property Tax Act of 1893:

http://www.legislature.mi.gov/(S(ygfzfsitbmmfmkxbkddyqz5d))/mileg.aspx?page=getObject&objectName=mcl-Act-206-of-1893

21Michigan Constitution Article IX: Finance and Taxation:

http://www.legislature.mi.gov/(S(gvlw1mw21iwgzgu4shecvz54))/mileg.aspx?page=getObject&objectName=mcl-Constitution-IX

22Mendard, Inc. Refund Amount:

https://www.bridgemi.com/public-sector/bipartisan-bills-michigan-lawmakers-take-fresh-aim-dark-store-taxes

23Tax Tribunal Court Documents for Walgreen https://taxdocketlookup.apps.lara.state.mi.us/Results.aspx?County=Dickinson&DocketNbr=&PetitionerRespondent

24Ford Motor Company v. City of Woodhaven, 475 Mich 415 (2006)

25General Property Tax Act of 1893: http://www.legislature.mi.gov/(S(ygfzfsitbmmfmkxbkddyqz5d))/mileg.aspx?page=getObject&objectName=mcl-Act-206-of-1893 Michigan Constitution Article IX: Finance and Taxation: http://www.legislature.mi.gov/(S(gvlw1mw21iwgzgu4shecvz54))/mileg.aspx?page=getObject&objectName=mcl-Constitution-IX

26See MCL Section 211.53a: “Any taxpayer who is assessed and pays taxes in excess of the correct and lawful amount due because of a clerical error or mutual mistake of fact made by the assessing officer and the taxpayer may recover the excess so paid…”

27Tax Tribunal Court Documents for Home Depot: https://taxdocketlookup.apps.lara.state.mi.us/Details.aspx?PK=101499

28Tax Tribunal Court Documents for Wal-Mart: https://taxdocketlookup.apps.lara.state.mi.us/Details.aspx?PK=132262

29Tax Tribunal Court Documents on Houghton County: https://taxdocketlookup.apps.lara.state.mi.us/Details.aspx?PK=129158

30City Manager statement’s on Walmart Case: http://www.keweenawreport.com/news/local-news/walmart-tax-battle-continues-houghton-council-report/

31Population Estimate from US Census Bureau: https://www.census.gov/quickfacts/fact/table/dickinsoncountymichigan/PST045219

32Local Editorial on Dark Store impacts in Marquette County: https://www.miningjournal.net/news/front-page-news/2020/08/dark-store-theory-revisited/

33New York Bill: https://rcbizjournal.com/2020/01/31/state-assembly-unanimously-passes-legislation-to-combat-dark-store-assessment-challenges/

34Link to Senate Bill No. 26: http://www.legislature.mi.gov/documents/2019-2020/billintroduced/Senate/pdf/2019-SIB-0026.pdf

35Link to MML Discussion of Legislation: https://www.mml.org/advocacy/dark-stores/