Earned Income Tax Credit Still an Important Piece of Tax Code for Lower-Income Families

The Earned Income Tax Credit (EITC) is a credit that is primarily aimed at reducing poverty, incentivizing work and relieving the tax burden of lower income families.

It is one of the more progressive tax policies in the United States, but was claimed by President Reagan to be “the best anti-poverty, the best pro-family, the best job-creation measure to come out of Congress.” (Furman).

It has been around since the seventies and was signed into law by President Ford. Generally, throughout its existence the EITC has garnered bipartisan support. In this brief essay you will find out how it works, how it came to be and the future of the EITC as an important piece of the American tax system.

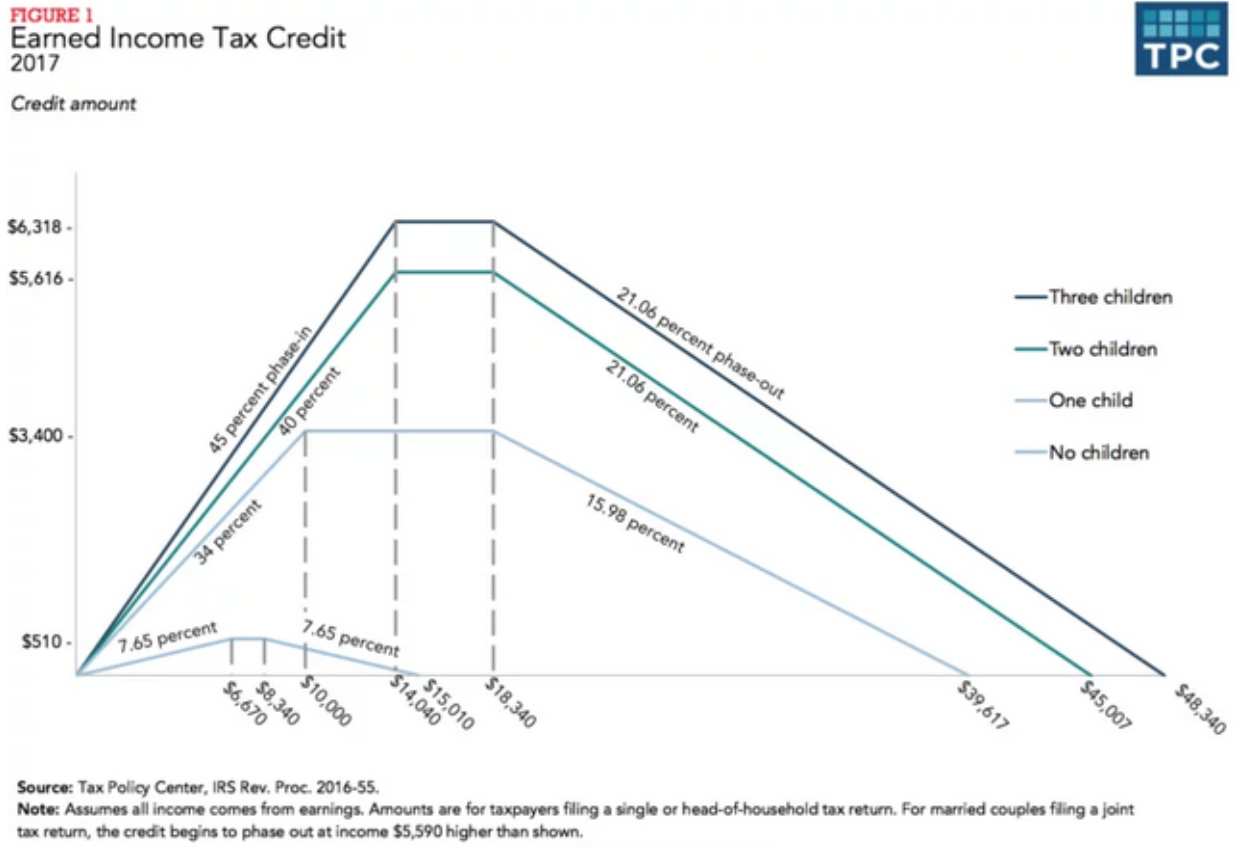

Earned income refers to the amount of earnings from wages, salaries and self-employment, excluding any other income with few exceptions. It works by following a curve depending on your filing status, with higher credit amounts going to larger families.

This means that for every dollar you make until your respective minimum threshold you will gain a larger tax credit. If you earn more than the maximum threshold, for every dollar earned after you would lose 21 cents of your credit or 21.06%.

For example, a two-child family earning $25,000 would get a tax break or credit of $5,192 in 2020. This would be more than the maximum threshold, so their credit goes down by about $600.

This tax break is targeted primarily at families, since they will see the largest returns.

For instance, in the tax year of 2018, more than 729,600 families in Michigan applied for the state EITC. For the federal EITC, that number was 763,940. The average state credit was $150 and the average federal credit collected by Michiganders was $1,651,

according to the Michigan League for Public Policy.

There are two types of EITC: state and federal. They are very similar, but the state’s EITC is 6% of federal, and if you qualify for the federal credit, you will qualify for the state.

The actual policy was enacted in 1975 under the Ford Administration (Hungerford). It was a byproduct of the 1960s debates on “negative income tax” or (NIT) and Nixon’s Family Assistance Plan. The article cited as “Hungerford” below has more information if you are curious about the policy’s conception and history of changes.

Research shows that the program’s net effect incentivizes people to work, according to the Tax Policy Center; but research also indicates it does not affect how many hours they work. A criticism of the credit is how the phase-out–much like progressive tax brackets–incentivizes staying beneath a threshold. However, there is no empirical data to suggest this.

Another criticism of the EITC, made by the Heritage Foundation, is that while the EITC plays an important role in the means-tested welfare safety net, it is rife with problems that include: fraud and erroneous payments due to false reports of earnings and false residence claims, benefits intended for working parents going to non-parents, very high multi-tier benefits, and discrimination against married couples.

The Heritage article makes a compelling case on why this piece of legislation can be taken advantage of. A few of the remedies they suggest for fixing this are:

- Require the IRS to fully verify reported income before any refundable EITC payment is made.

- Allow only those with formal legal custody of a child to claim the EITC and ACTC for that child.

- Prohibit families with dependent children from receiving EITC and ACTC benefits if they are also receiving public housing assistance.

Looking forward, the House of Representatives has recently introduced legislation that would expand the EITC for non-parental workers in lieu of the pandemic. This would raise the return for “childless workers.”

Regardless of its flaws, the Earned Income Tax Credit is a powerful piece of the tax code that incentivizes work, relieves tax burden on lower income families and Americans, and generally is supported across the aisle.

Citations

Hungerford, T. L., & Thiess, R. (2013, September 25). The Earned Income Tax Credit and the Child Tax Credit: History, Purpose, Goals, and Effectiveness. Economic Policy Institute. https://www.epi.org/publication/ib370-earned-income-tax-credit-and-the-child-tax-credit-history-purpose-goals-and-effectiveness/.

USGOV, I. R. S. (21–03-12). Earned Income and Earned Income Tax Credit (EITC) Tables | Internal Revenue Service. Www.Irs.Gov. https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/earned-income-and-earned-income-tax-credit-eitc-tables.

Furman, J. (2014). Poverty and the Tax Code. NA, 1(1), https://obamawhitehouse.archives.gov/sites/default/files/docs/democracy_article_on_poverty_and_the_tax_code_jf.pdf.

Meyer, B. D. (2002, May 1). Labor Supply at the Extensive and Intensive Margins: The EITC, Welfare, and Hours Worked. American Economic Association. https://www.aeaweb.org/articles?id=10.1257/000282802320191642.

TPC. (2020, May 1). What is the earned income tax credit? Tax Policy Center. https://www.taxpolicycenter.org/briefing-book/what-earned-income-tax-credit.

Rector, R. (2016, February 16). Reforming the Earned Income Tax Credit and Additional Child Tax Credit to End Waste, Fraud, and Abuse and Strengthen Marriage. The Heritage Foundation. https://www.heritage.org/welfare/report/reforming-the-earned-income-tax-credit-and-additional-child-tax-credit-end-waste.

Marr, C., & Cox, K. (2021, February 9). House COVID Relief Bill Includes Critical Expansions of Child Tax Credit and EITC. Center on Budget and Policy Priorities. https://www.cbpp.org/research/federal-tax/house-covid-relief-bill-includes-critical-expansions-of-child-tax-credit-and.