Research

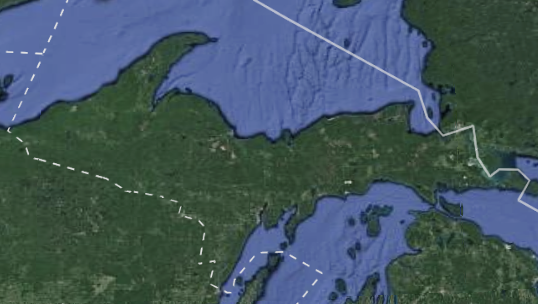

Assessing Socioeconomic Trends and Disparities in Michigan’s Upper Peninsula: A County-by-County Analysis

We occasionally publish research by NMU students, and this article is an example of this student research. We wanted to give our readers…

Earned Income Tax Credit: Max Steele’s Analysis

Rural areas have several demographic components that lend themselves to having a great need for Earned Income Tax Credits (EITC), a sort of…

Recent Population Changes in the U.P. Amidst the Pandemic

The population dynamics of Michigan’s Upper Peninsula are well documented. Its population, like most rural regions in the United States, is in decline….

Boom and Bust: Calumet and Keweenaw National Historical Park 30 Years On

Many communities throughout the Upper Peninsula have developed their sense of place from the mining industry. On the Keweenaw Peninsula, copper mining dominated…

Survey Shows Diversity of NMU’s Student Veterans

Diversity is something that members of America’s armed forces inadvertently come to cherish and appreciate. You learn quickly that the color of one’s…

Housing Rental Cost Dynamics in Michigan’s Upper Peninsula

Housing prices in the US have been increasing at an average rate of 7% over the last seven years. The Upper Peninsula has…

Childcare: An Overview of Costs and Solutions

Childcare is one of the most pressing issues to the modern working family. With costs as high as the price of a mortgage,…

Hidden Homelessness in the Upper Peninsula

Hidden homelessness is a scary reality–it can affect friends, family, and others in the community. Some people may call it “couch surfing,” but…

A Quantitative Analysis of GDP in the Upper Peninsula

The data listed here comes from the Bureau of Economic Analysis (BEA). The BEA is a government agency that focuses on producing economic…

Dark Store Theory in Michigan’s Upper Peninsula: Impacts and Predictions

NMU student researcher Isabelle Karl gives an in-depth look at the losses in revenue and increased costs for local governments in Michigan’s Upper Peninsula due to tax breaks given to big box stores under the “dark store” loophole. She also discusses current legislative efforts to change how big box stores in Michigan are taxed in order to bring more revenue to local communities.